Skoda Kylaq Sales January 2026: January 2026 once again underlined a widening gap within the Volkswagen Group’s India operations. While Skoda Auto India posted strong year-on-year growth driven largely by the Kylaq, Volkswagen Passenger Cars India continued to lose ground.

The contrast highlights how product positioning, especially in the sub-4 metre segment, is shaping fortunes in the Indian market.

Also Read: Global EV Sales Fall 3% in January 2026 as China and US Demand Slows

Skoda Kylaq Sales January 2026- Growth story

Skoda delivered 5,739 vehicles in January 2026, marking a 39 percent increase over the 4,133 units sold in January 2025. The Kylaq alone accounted for more than half of Skoda’s monthly volumes, underlining its importance to the brand’s India strategy.

Skoda India – Model-wise Sales (January 2026 vs January 2025)

| Model | Jan 2026 Sales | Jan 2025 Sales | YoY Change |

|---|---|---|---|

| Kylaq | 3,220 | 1,242 | +159% |

| Slavia | 1,946 | 1,510 | +29% |

| Kushaq | 434 | 1,371 | -68% |

| Kodiaq | 139 | 10 | +1,290% |

| Octavia | 0 | NA | – |

| Total | 5,739 | 4,133 | +39% |

Callout: Why this table matters

This table makes it clear that Kylaq is the single biggest growth driver for Skoda. Even with the Kushaq seeing a sharp decline, overall volumes rise because the Kylaq operates in the high-demand sub-4 metre SUV segment.

The Kylaq recorded 3,220 units in January, translating to a 159 percent year-on-year jump. Prices starting at Rs 7.59 lakh (ex-showroom) place it squarely in India’s most competitive and tax-efficient category.

Slavia provides stability, SUVs provide scale

The Slavia’s 1,946-unit performance shows that sedans can still deliver consistent numbers when priced and positioned correctly. However, it is the Kylaq that provides scale.

In contrast, the Kushaq’s 68 percent decline reflects its runout phase. With a facelift due next month and expected to be priced higher, buyers appear to be delaying purchases. This highlights how product lifecycle timing can temporarily distort brand performance even when demand exists.

Volkswagen struggles without a sub-4 metre offering

Volkswagen sold 2,710 cars in January 2026, marking a 19 percent year-on-year decline. Unlike Skoda, Volkswagen does not have a sub-4 metre SUV, leaving it exposed to slowdowns in the sedan and mid-size SUV segments.

Volkswagen India – Model-wise Sales (January 2026 vs January 2025)

| Model | Jan 2026 Sales | Jan 2025 Sales | YoY Change |

|---|---|---|---|

| Virtus | 1,881 | 1,795 | +5% |

| Taigun | 790 | 1,548 | -49% |

| Tiguan | 34 | 1 | +3,300% |

| Tayron | 5 | NA | – |

| Golf | 0 | NA | – |

| Total | 2,710 | 3,344 | -19% |

Callout: What this table reveals instantly

Volkswagen’s volumes are over-dependent on the Virtus, while the Taigun’s near-50 percent decline exposes weak demand in the mid-size SUV space. Premium models add image value but do not add volume.

Premium launches help perception, not numbers

The third-generation Tiguan and the newly dispatched Tayron show strong percentage growth, but from a very low base. Together, they contributed fewer than 40 units in January.

This reinforces a key reality of the Indian market:

premium imports and CKD models cannot compensate for the absence of a high-volume, entry-level SUV.

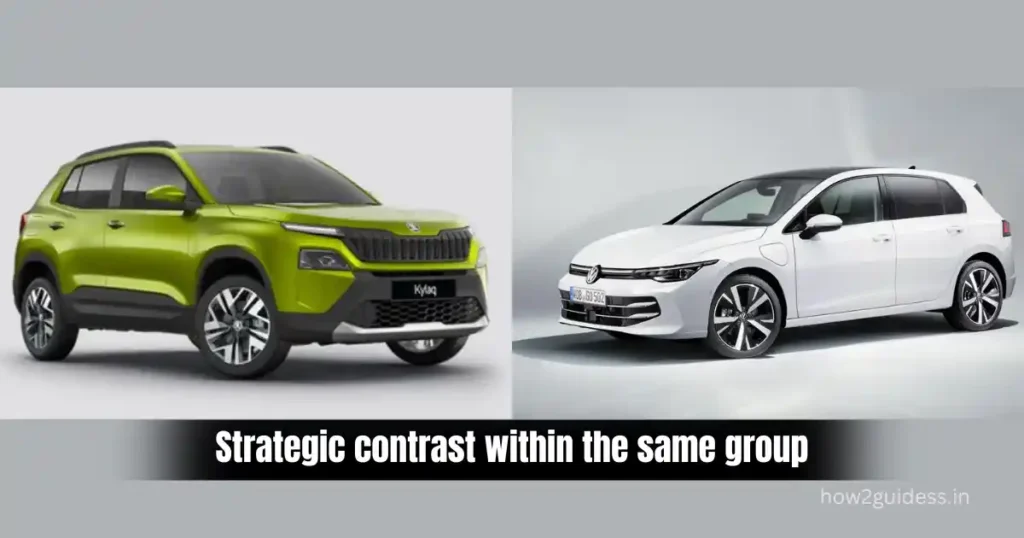

Strategic contrast within the same group

What makes this divergence striking is that Skoda and Volkswagen share platforms, engines and local manufacturing infrastructure. Yet outcomes differ sharply.

Skoda’s decision to prioritise a competitively priced sub-4 metre SUV has insulated it from declines elsewhere. Volkswagen’s portfolio, meanwhile, remains skewed toward higher price points where demand is narrower and more volatile.

What this means for Indian buyers

For buyers, Skoda’s rising volumes translate into stronger dealer confidence, better supply consistency and likely continued investment in updates and variants. The Kylaq’s success may also accelerate localisation and feature upgrades.

Volkswagen buyers, on the other hand, continue to face limited choice below Rs 10 lakh. While the Tayron expands the top end, it does little to address the brand’s core volume challenge.

Conclusion

Skoda Kylaq Sales January 2026 reinforces a well-established truth in the Indian car market: growth flows from the right segments, not just good products. Skoda’s Kylaq has become the backbone of its India operations, offsetting declines elsewhere and driving overall expansion.

Volkswagen’s continued slide, despite capable models, highlights the cost of missing out on the sub-4 metre SUV space. Unless that gap is addressed, the performance divide within the Volkswagen Group in India is likely to widen further in the months ahead.

Disclaimer: Sales figures and analysis in this article are based on manufacturer-released data and publicly available information. Monthly volumes may vary due to stock availability, model lifecycle changes and market conditions.

Also Read: Tata Motors January 2026 Sales Analysis: Nexon, Punch, Sierra Drive Growth

Raj Prajapati is a senior automobile content writer at How2Guidess.in with over 3 years of experience in auto news, vehicle launches, comparisons, and EV updates. With a background in Computer Science & Engineering, he focuses on research-based, clear, and reader-friendly automobile content.