Two Wheeler Sales January 2026: India’s two-wheeler market started 2026 on a strong note, with retail sales showing healthy growth across regions and segments. January 2026 retail volumes indicate that demand is no longer driven only by festive buying but is increasingly supported by routine replacement and upgrade cycles.

At the same time, the data also highlights where momentum is slowing, particularly in electric two-wheelers.

Here is a clear breakdown of what the January 2026 numbers reveal and what they mean for the Indian two-wheeler market.

Also Read: Hero Vida Ubex Electric Bike Design Patented in India, Production Version Likely

Two Wheeler Sales January 2026- Overall Market Performance

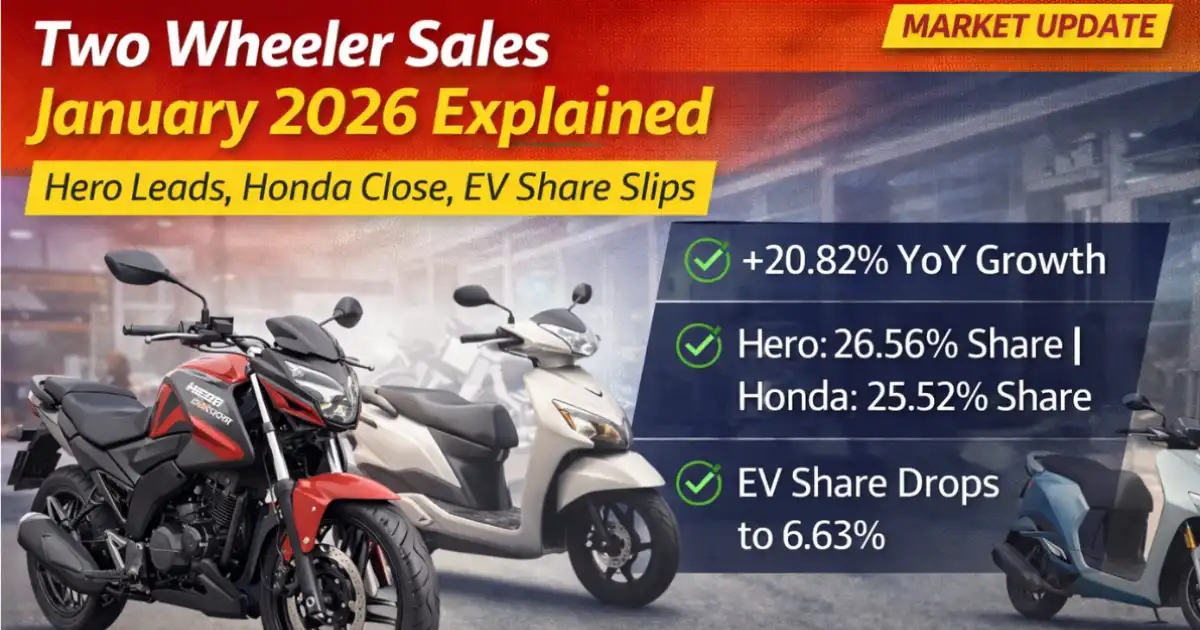

Total two-wheeler retail sales in January 2026 stood at 18,52,870 units. This represents a year-on-year growth of 20.82 percent compared to January 2025 and is also higher than December 2025 volumes.

This rise suggests sustained consumer confidence, helped by improved rural cash flows, steady urban employment, and better vehicle availability across dealerships. Unlike earlier periods, demand is now less dependent on festive spikes and more evenly spread through the month.

Rural vs Urban Demand Trends

Rural markets continued to account for a larger share of total sales at around 56 percent. Entry-level commuter motorcycles and scooters remain essential mobility tools in smaller towns and villages, keeping rural volumes strong.

However, urban markets grew faster in percentage terms, posting a 22.19 percent year-on-year increase. This indicates a return of urban buyers to showrooms for replacement purchases, upgrades, and lifestyle-oriented products. For manufacturers, this balance between rural volume stability and urban growth is a positive signal.

Hero and Honda: A Tight Race at the Top

Hero MotoCorp retained its position as the market leader in January 2026. The company recorded retail sales of 4,92,167 units, giving it a 26.56 percent share of the total two-wheeler market.

Close behind was Honda Motorcycle and Scooter India, which sold 4,72,938 units and captured a 25.52 percent market share. The narrow gap between the two highlights how competitive the mass-market segment has become, particularly in scooters and commuter motorcycles.

TVS, Bajaj, and Royal Enfield Performance

TVS Motor Company held on to third place with 3,64,241 units sold, translating to a 19.66 percent share. TVS continues to benefit from a balanced portfolio covering scooters, commuters, and premium motorcycles.

Bajaj Auto Group recorded sales of 1,95,752 units, giving it a 10.56 percent market share. Bajaj’s performance reflects steady demand in the commuter and entry-level sports segments.

Royal Enfield sold 1,06,398 units, accounting for 5.74 percent of the market. These numbers indicate that the mid-size and lifestyle motorcycle segment continues to attract buyers, even in a price-sensitive environment.

Performance of Other Manufacturers

Among other brands, Suzuki Motorcycle India sold 98,899 units, taking a 5.34 percent share. India Yamaha Motor followed with 64,399 units and a 3.48 percent share.

Classic Legends reported 4,940 units, which translates to a 0.27 percent market share. While smaller in volume, these brands continue to serve niche customer bases.

Electric Two-Wheelers: Growth Pauses

Electric two-wheelers accounted for 6.63 percent of total retail sales in January 2026. This is a slight drop from the 7.4 percent share recorded in December 2025, indicating that EV momentum slowed at the start of the year.

Ather Energy led the electric segment with 21,999 units, followed by Ola Electric at 7,516 units. Greaves Electric Mobility sold 5,337 units, while Piaggio Vehicles, River Mobility, and Bgauss Auto posted smaller volumes.

The combined ‘Others including EV’ category stood at 10,281 units, showing that the long tail of smaller EV brands remains active, even if overall share is limited.

Fuel-Type Split Remains ICE-Dominated

Petrol and ethanol-powered two-wheelers dominated the market, accounting for 93.27 percent of January 2026 sales. Electric vehicles made up 6.63 percent, while CNG and LPG two-wheelers contributed just 0.10 percent.

For buyers, this underlines that internal combustion engine two-wheelers remain the default choice due to price, refuelling convenience, and widespread service support. EV adoption, while growing over the long term, is still sensitive to pricing, subsidies, and charging infrastructure.

What This Means for Buyers and the Industry

For consumers, the January numbers suggest better availability, stable pricing, and a wide range of options across segments. For manufacturers, the data highlights the importance of strong rural networks, competitive urban offerings, and cautious EV expansion aligned with real-world demand.

Conclusion

Two Wheeler Sales January 2026 retail data shows a market that is growing steadily and becoming more balanced across regions. Hero MotoCorp remains the leader, Honda is close behind, and mid-size motorcycles continue to find buyers.

At the same time, electric two-wheelers saw a slight dip in share, reinforcing that the transition away from petrol will be gradual rather than immediate.

Disclaimer: Sales data is based on available retail figures and may change as late registrations or corrections are updated.

Also Read: 2026 KTM 790 Duke Revealed: New Design Inspired by Bigger Dukes

Raj Prajapati is a senior automobile content writer at How2Guidess.in with over 3 years of experience in auto news, vehicle launches, comparisons, and EV updates. With a background in Computer Science & Engineering, he focuses on research-based, clear, and reader-friendly automobile content.